The Definitive Guide to Estate Planning Attorney

The Definitive Guide to Estate Planning Attorney

Blog Article

The Facts About Estate Planning Attorney Uncovered

Table of ContentsNot known Details About Estate Planning Attorney Not known Incorrect Statements About Estate Planning Attorney Estate Planning Attorney Can Be Fun For EveryoneThe Main Principles Of Estate Planning Attorney Estate Planning Attorney for Beginners

Powers of lawyer need to clearly specify the specific powers given to and restrictions enforced on the attorney-in-fact. A long lasting power of attorney is designed to continue to be efficient throughout a person's incapacity, therefore works for preventing the consultation of a guardianship or conservatorship. A power of attorney might likewise include a declaration of the grantor's desires, for instance, regarding life-sustaining treatment or specific investment suggestions.

This suggests that business is owned by a general companion, who handles and controls business, and one or more minimal partners. You can after that move your properties into the name of the partnership, thus minimizing the value of your estate and the quantity that will be due in estate taxes.

Estate Planning Attorney Fundamentals Explained

Often, distributing a family-owned company triggers disagreements and tension among member of the family. Those that have actually been associated with running business may really feel that they are entitled to a bigger share. But if you have a clear succession plan in position, this can reduce several of the opinion. A lawyer can deal with you on sequence planning to select who will possess and run the company.

A decedent's surviving partner may include any type of extra part of the decedent's exemption quantity to his/her own amount with choosing transportability, making a surviving spouse's exemption quantity a maximum of $10.86 million. Submitting an inheritance tax return is a complicated and frequently complex process that is finest entrusted to a skilled attorney.

David Toback is an attorney and therapist, and his office is not just a record composing solution - Estate Planning Attorney. We do even more than offer you with an expensive binder that you can stick on your shelf and never ever consider once more. Whether you are simply starting or have actually been long-established in company and increased a household, you understand that life is filled up with changes life occasions such as marriages, divorces, births and fatalities; and company and residential or commercial property visit this site right here deals and other opportunities that provide themselves

How Estate Planning Attorney can Save You Time, Stress, and Money.

David Toback is right here to make sure you are always safeguarded which your estate plan is always functioning for you in the means you want it to, contact our Tampa florida estate planning attorneys today. David Toback maintains offices in Tampa bay, St. Petersburg and other locations throughout Hillsborough and Pinellas regions.

Home > Estate Preparation Wills & Trusts Estate preparing guarantees that your residential or commercial property and properties will certainly be distributed based on your wishes. There are several estate preparation devices visit this site right here that can benefit you depending on your residential or commercial property, worries, and wishes. Situated in West Palm Coastline, Florida, Mark Shalloway and the attorneys at Shalloway & Shalloway, P.A., have assisted thousands of clients with estate planning, including drafting wills and counts on.

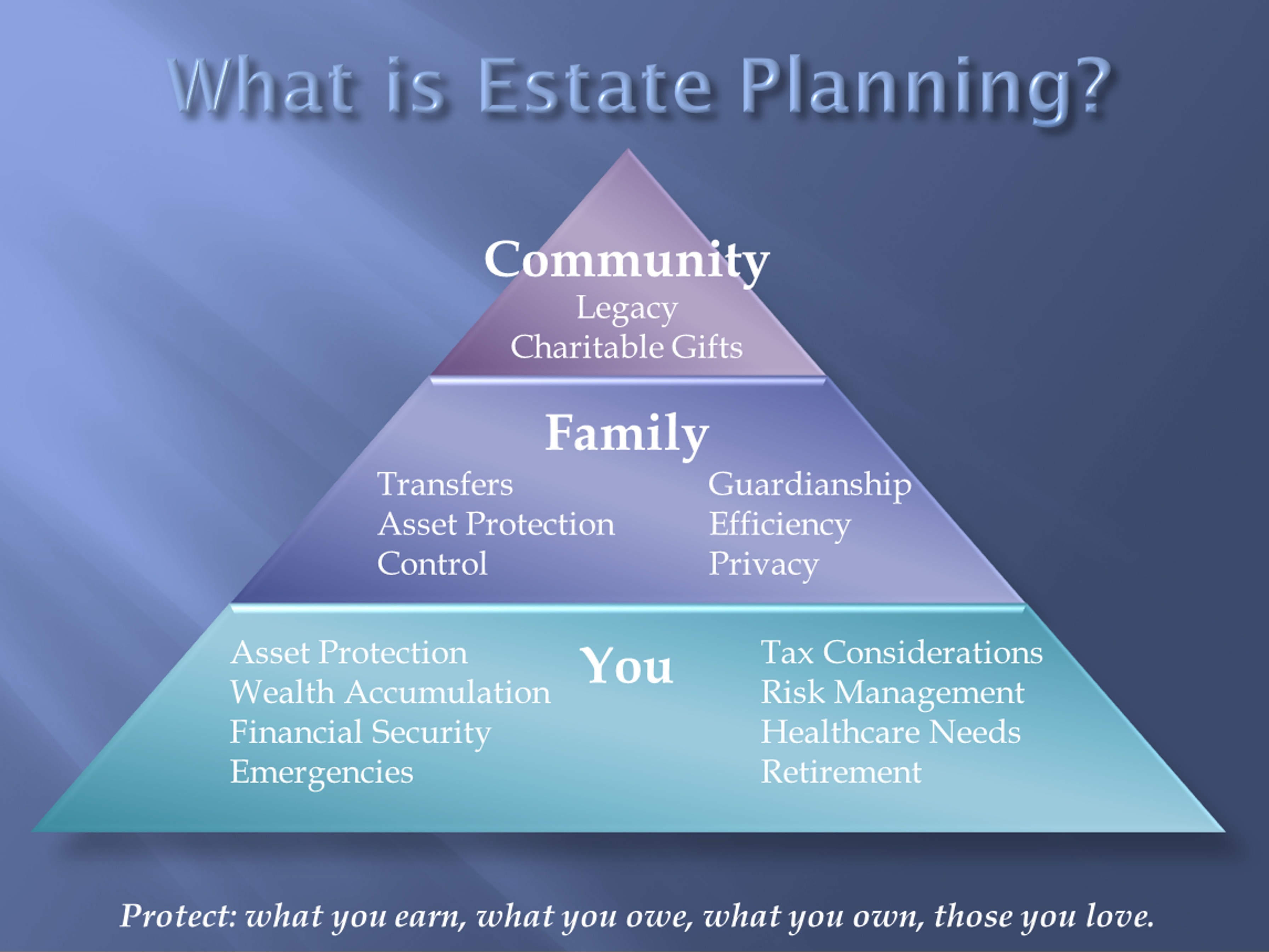

When it pertains to estate preparation, we instantly think about composing depends on or a will. Estate Planning Attorney. To the contrary, estate preparation involves a cautious review of your properties and property along with considering your health to prepare papers that will certainly communicate with one an additional in the occasion your health deteriorates or upon death

The Buzz on Estate Planning Attorney

Trust funds, on the various other hand, permit smooth and private handling of property circulation without or limited court participation. Revocable or living useful source trust funds are trusts that are developed throughout the grantor's lifetime and can be amended or revoked. Revocable trusts are practical in preventing probate and will guarantee that your properties are distributed according to your wishes upon fatality.

These documents are most likely to have an instant influence on an aging customer's life. A senior regulation attorney also comprehends that estate planning, consisting of disposal of possessions, should go hand in hand with Medicaid intending for maturing customers. Probate is the lawful process needed to prove the credibility of a will and the fulfillment of a deceased's documented yearn for their properties.

No. While numerous law office in Florida advertise Medicaid planning solutions, few are experts in the field. Medicaid is a complex program with both state and federal requirements. A real Medicaid preparation attorney have to keep an eye on changes in both state and government legislations and regulations and be in harmony with the strategic choices called for when preparing for Medicaid qualification.

Some Known Questions About Estate Planning Attorney.

It is best to involve an elder law attorney prior to you need Medicaid, an advanced regulation, power of attorney, and prior to you are dealing with complex medical issues. While there is no single age that makes feeling for each and every individual, take into consideration setting up an assessment with an elder law lawyer by the age of 65.

Rate is a key consideration in picking an attorney. Some attorneys offer a complimentary consultation; others don't.

Report this page